Tax bracket calculator

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1.

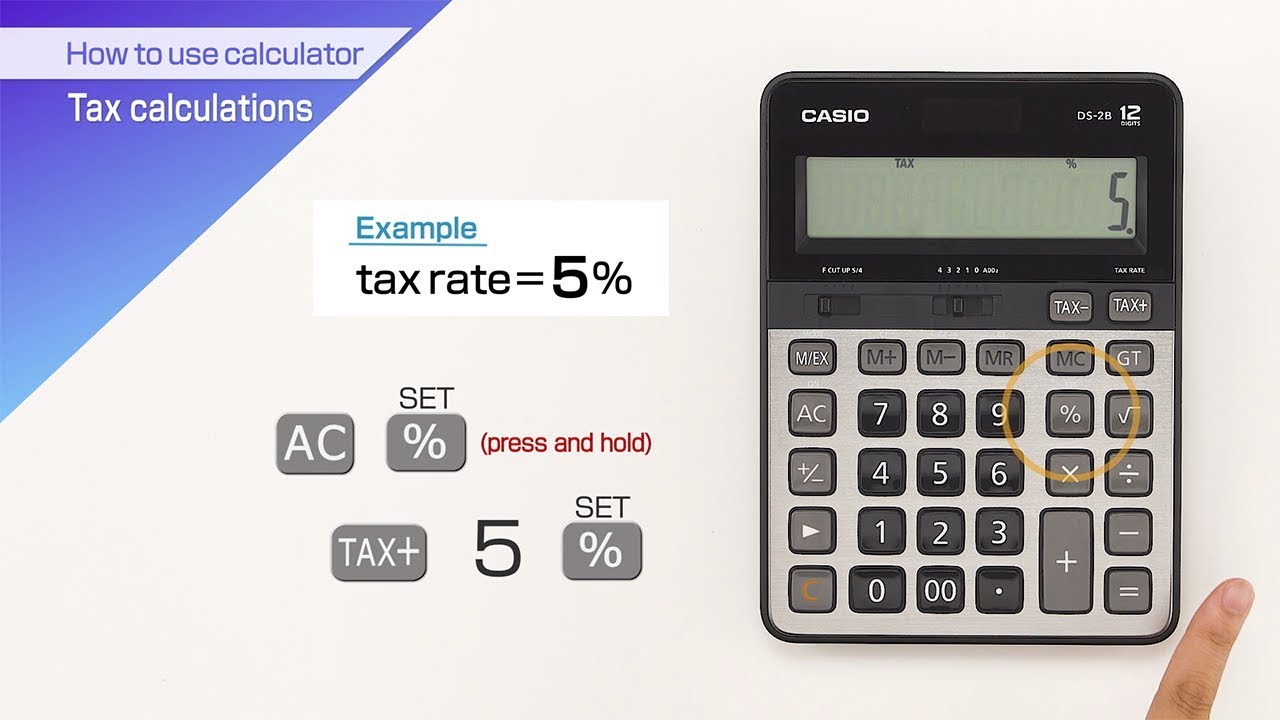

Casio How To Use Calculator Tax Calculations Youtube

TurboTax Online prices are determined at the time of print or electronic filing.

. The first 10k is taxed at 10. It is mainly intended for residents of the US. Class 1A Rate On.

Ad Get the Latest Federal Tax Developments. Youll pay rates across 3 tax brackets. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

There are seven federal income tax rates in 2022. Tax Bracket Calculator Estimate my effective tax rate. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10. FAQ Blog Calculators Students Logbook. Your bracket depends on your taxable income and filing status.

New chancellor Kwasi Kwarteng said the cut in the basic rate of income tax from 20 to 19 would benefit more than 31 million people. The cut which applies to annual. For the current tax year use this Income Tax Calculator or RATEucator.

Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Calculate your income tax bracket 2021 2022. Use Tax Calculator to know your estimated tax rate in a few steps.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The next 305k is taxed at 12. Above Upper Earnings Limit.

Personal tax credit employee credit and Earned Income Credit are all set to rise by 75 while the the Home. To use the calculator you will need the following information. The personal income tax rate for the first bracket will be reduced from 3707 per cent in 2022 to 3693 per cent in 2023.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

The new 2018 tax brackets are. The next six levels are. 10 12 22 24 32 35 and 37.

Up to 10 cash back TaxActs free tax bracket calculator is a simple easy way to estimate your federal income tax bracket and total tax. You can no longer e-File 2021 Tax Returns. For instance take a single worker whose taxable income this year is.

Stock Market Investing Online Calculators Valuation. 40680 26 of taxable income. It can be used for the 201314 to 202122 income years.

For Tax Year 2021 use the Tax Bracket Calculator below. Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

Once you have this information you simply plug the numbers into the system and your. Reduced personal income tax rate for first bracket. Tax brackets determine the tax rate youll pay on each portion of your income.

The lowest tax bracket or the lowest income level is 0 to 9950. 3 hours agoThis entry point increase will amount to 640 for most PAYE workers. In this case youd pay about 113k in.

Try now for Free. In other words total taxes paid divided by total income. 18 of taxable income.

Ad Try Our Free And Simple Tax Refund Calculator. 100 Accurate Calculations Guaranteed. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Your tax filing status. And is based on the tax brackets of 2021 and. TurboTax experts are available from 9 am.

Employers Rate Above Secondary Threshold. The effective tax rate is the average tax rate you will pay on your income. The final 30k is taxed at 22.

2021 Federal Income Tax Brackets and Rates. As of 2016 there are a total of seven tax brackets. New tax brackets for 2023.

Rates for Class 1 NICs. Ad A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate. 2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000.

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. All prices are subject to change without notice. Find all 2021 tax.

Ad Get the Latest Federal Tax Developments. There are seven federal tax brackets for the 2021 tax year. Between Primary Threshold and Upper Earnings Limit.

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

How To Calculate Income Tax In Excel

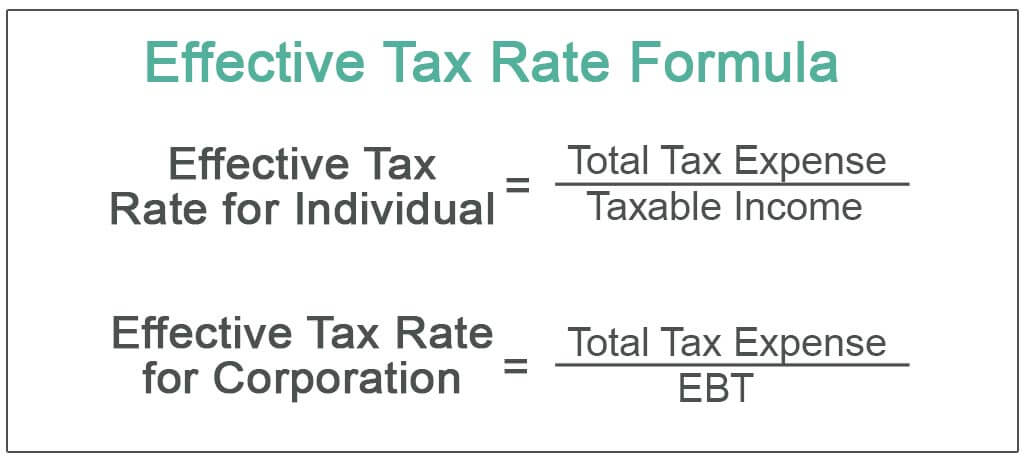

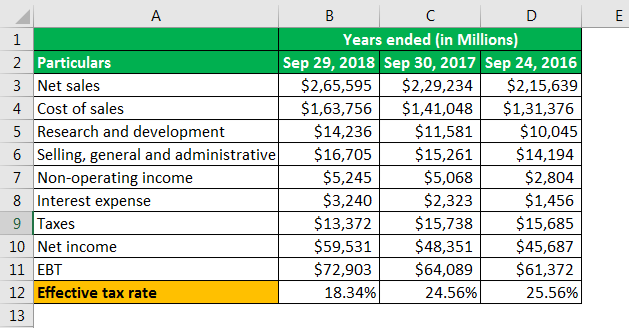

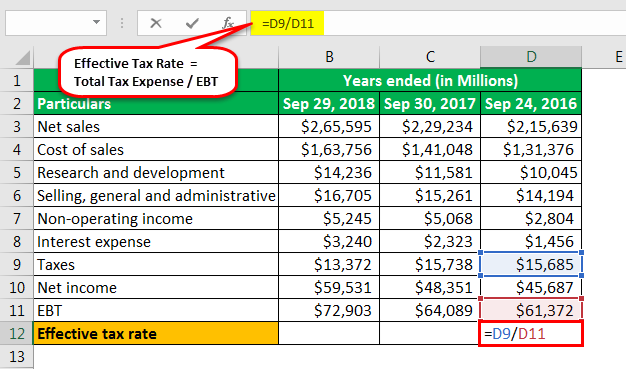

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Formula Calculator Excel Template

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Inkwiry Federal Income Tax Brackets

Income Tax Formula Excel University

Income Tax Formula Excel University

Effective Tax Rate Definition Formula How To Calculate

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Sales Tax Calculator

How To Calculate Income Tax In Excel

Effective Tax Rate Formula And Calculation Example

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Definition Formula How To Calculate