Mortgage calculator twice monthly payments

In the example above a 10 down reduces your principal to 315000 while a 20 down further decreases your principal to 280000. Bankrate is compensated in exchange for featured placement of.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

If you choose well also show you estimated property taxes and homeowners insurance costs as.

. Mortgage Calculator With Extra Payments. To Compare Loan Types. The mortgage payment estimate youll get from this calculator includes principal and interest.

This allows you to see how changing rates can impact your monthly payments. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. We provide a UK mortgage amortisation calculator.

A 30 year mortgage for 100000 at a rate of 65 means the homeowner will pay 127544 in interest throughout the life of the loan. However some lenders offer a bi-monthly payment service to homebuyers. Use the Extra Payments Calculator 2 to understand how making additional payments may save you money by decreasing the total amount of.

If your lender does not offer a bi-weekly option or charges for the service you can do. Use our mortgage calculator to compare different types of mortgages and loan terms to decide which one works best for you. If you pay 10 down your monthly payment will cost.

This also includes a 100000 principal for a grand total. You can compare interest-only payments and fixed-rate. Why Use a Mortgage Calculator.

Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home. Off the loan four months earlier. Use our free mortgage calculator to estimate your monthly mortgage payments.

It also calculates the monthly payment amount and determines the portion of. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. The payment option commonly called bi-monthly is a bi-weekly payment option.

Account for interest rates and break down payments in an easy to use amortization schedule. How we make money. If using bi-weekly payments the interest is only 15097771 saving you 3553386 over the life of the loan.

This calculator will show you how.

Extra Payment Mortgage Calculator For Excel

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator

How To Calculate Mortgage Payments In Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator How Much Will You Save

Bi Weekly Mortgage Payment Calculator

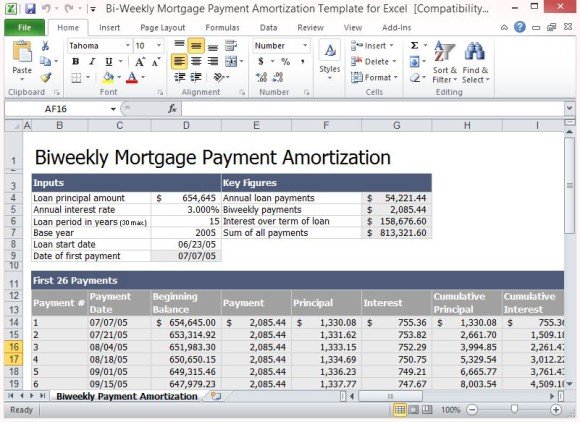

Bi Weekly Mortgage Payment Amortization Template For Excel

Biweekly Mortgage Calculator How Much Will You Save

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Pay Off Mortgage Early Mortgage Payment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template